The Issue With The Conventional Roadside Assistance and Claims

Roadside assistance and insurance claims have been a time consuming and fractured process over the decades:

- Customers have to call hotline numbers, wait long and repeat their data many times.

- Processing insurance claims underwent the hassle of manual paperwork, slow approvals and no real time updates.

- The service providers had difficulty in scaling up, say in peak hours of the day.

- End-users were not too aware or transparent to the status of the requests.

The disconnect between the expectations of customers and the conventional service delivery made this aspect (intelligent, reliable, and scalable solution) a need.

Welcome AutoAssist.AI: The game-changer

AutoAssist.AI is an intelligent and AI-driven chatbot that is explicitly created to meet all these challenges in full measure.With a combination of conversational AI, real-time automation, and easy-to-integrate capabilities with RSA and insurance processes, it provides:

- 24/7 availability-There is no place to wait and there are no office hours.

- Instant roadside assistance (RSA) booking- Affiliates a user to the closest road side assistance provider.

- Claims automation - takes a user through the document uploads, tracking of claims and resolving.

- Cross domain compatibility- the system is compatible with motor, travel, and health insurance claims.

- Omnichannel availability -available on the web, mobile app and through WhatsApp.

AutoAssist.AI Smart features

- How do I get roadside assistance? Consider that your car has a breakdown in the middle of the night.Rather than panicking you can launch AutoAssist.AI, share your location, and get real-time RSA support.The chatbot will immediately communicate with the closest certified RSA provider and make sure you are assisted, as soon as possible.

- With AI-Driven Claims Resolution the average number of dollars per claim is reduced:Claiming insurance does not feel like an easy task, and AutoAssist.AI enables efficient claim-filing:Gathers necessary information of the customer.Takes them through phase-by-phase document uploads.Offers on-time status of claim and claim tracking.Facilitates minimization of the manual intervention and decreasing approval time.

- Health and travel selection support provides an extension to insurance propositions in health and travelling. For example: A traveler is able to have a quote of custom travel insurance in an instant.By just making one query, a policyholder would be able to compute his/her Temporary Total Disability benefits.

- Omnichannel Accessibility AutoAssist.AI can be offered on the platforms that customers already use, however in a form of a mobile app, a web interface, or a WhatsApp chat.This adaptability gives the highest adoption and comfort to the customers.

- Smart Algorithms to PersonalizationThe chatbot incorporates AI algorithms to make specific experiences unique such as:Recommending RSA packagesProviding custom quotations on insuranceSupporting them with help in context relying on user history.

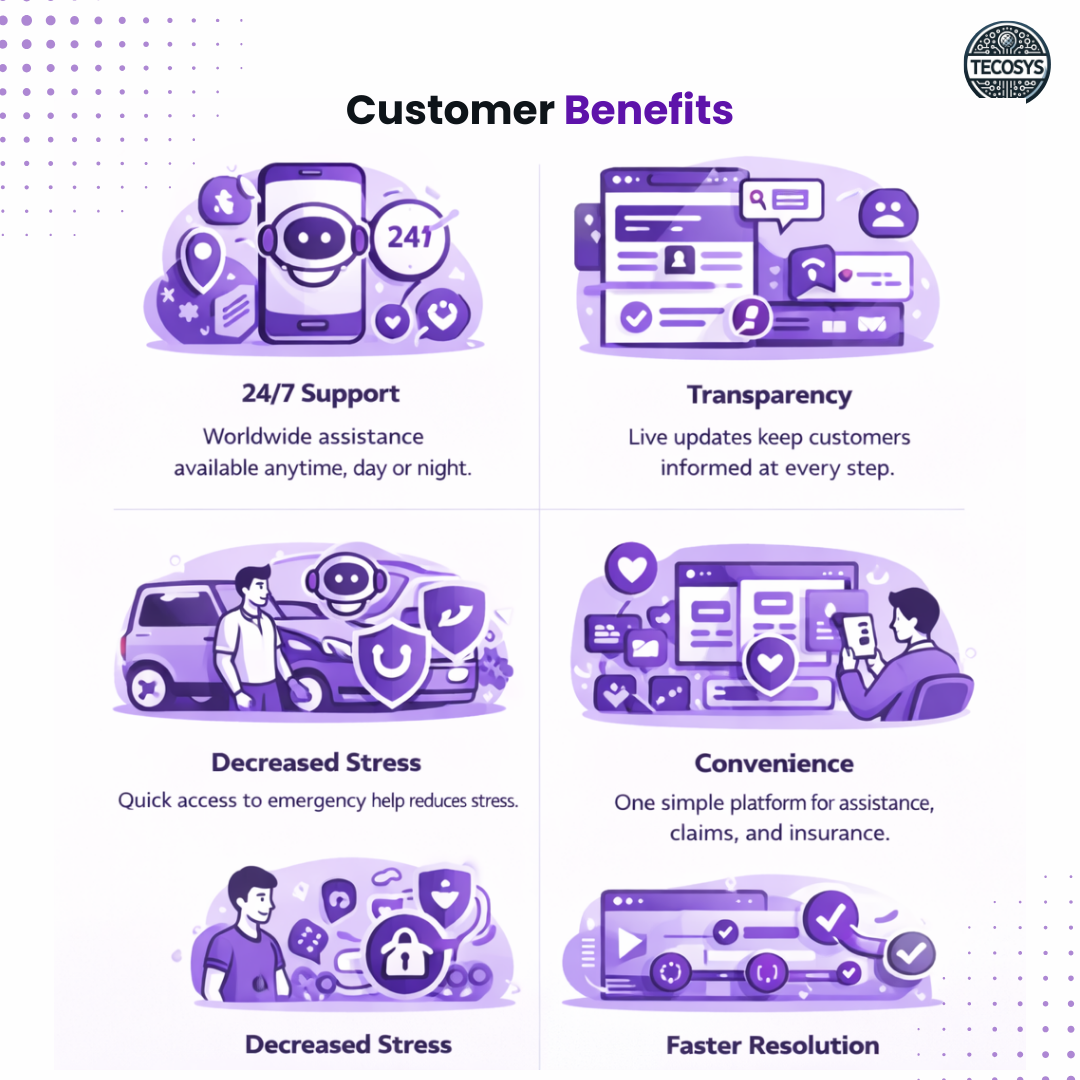

Customer Benefits

- 24/7 Support: Worldwide assistance that is available around the clock.

- Transparency: Claim status real time updates.

- Convenience: Convenient single site where one can get RSA, claims and insurance.

- Decreased Stress: Emergency care is accessible with ease when needed the most.

- Faster Resolution: Workflows are automated, which eliminates delays.

Advantages to Businesses & Insurers

- Operational Efficiency: No high dependency on manual support agents.

- Scalable: Thousands of requests can be handled by it.

- Cost Savings: The AI-based automation will reduce the operational cost.

- Customer Satisfaction: Customer satisfaction with enhanced user experience translates into loyalty and trust.

- AI Links: AI is used to obtain data to enhance services on how customers interact.

Why AutoAssist.AI is Better

- Integration-first approach :AutoAssist.AI is easily connected to RSA networks and insurance providers.

- Trust and Transparency: Customers are also in a position to track claims and RSA requests in real-time achieving full visibility.

- Future-Ready: The chatbot learns and is constantly refined with machine learning to increase accuracy and personalization.

- Human and AI Collaboration: AI deals with the repetitive duties whereas the cases requiring complex treatment can be deferred to human professionals.

Real life Use Case Scenarios

- Scenario 1- Roadside Breakdown

One customer stalled on a highway at night orders RSA via AutoAssist.AI on WhatsApp.In minutes, the closest tow truck is sent and the user can trace its arrival.

- Scenario 2- Motor Insurance Claim

A driver uses AutoAssist.AI to start a claim after a minor accident and uploads the required documents and then receives a real time status update until settlement.

- Scenario 3- Travel Insurance

Someone planning a trip receives instant personalised insurance quoting that covers insurance according to destination and the length of the trip.

The Enlarged Picture: AI in Insurance & Aid

AutoAssist.AI is more than a chatbot it is the future of AI in customer support.The top players across the globe are implementing AI to enhance customer connection, decrease turnaround time and save on money.AutoAssist.AI provided by Tecosys is a complete solution that integrates elements of RSA, insurance claims and customer support in a single, intelligent interface.

It has never been more important that the demand of instant, transparent and reliable support.AutoAssist.AI by Tecosys is a top overhaul of potential interactions between customers and insurance services through RSA.AutoAssist.AI helps to deal with any level of car troubles as well as to rent cars and receive on-demand assistance based on the AI-driven support concept, automation of the claims, and personalized insurance product offering.

To the customers, it will translate to having peace of mind.To businesses it translates to efficiency, cost- effectiveness, and customer loyalty.To the industry, it is a new period of intelligent help through AI.

Assistance is being re-defined by AutoAssist.AI.Whether it is roadside breakdown, insurance claims, or any other form, our 24/7 AI powered platform provides it all. AutoAssist.AI is transforming the way people receive support globally by making it faster, smarter, and more transparent.

AutoAssist.AI provides the convenience and reliability of having help at hand whenever you need it in a world where timing and reliability matter most.

Tired of waiting and wasting time ?

Looking at AutoAssist.AI by Tecosys - the 24/7 virtual assistance that provides you with roadside support, claims and insurance convenience.

Request a demo now and understand how AutoAssist.AI can help make customer support a smooth process.

Contact Tecosys and begin your adventure with 24/7 AI-powered customer support.

Frequently Asked Questions

Q1. What is AutoAssist.AI?

AutoAssist.AI is an artificial intelligence-powered virtual agent being developed by Tecosys, to ease the booking of roadside assistance (RSA), insurance claims resolution, and insurance offer proposals.

Q2. What is the AutoAssist.AI solution and how can it assist me in a roadside emergency?

It immediately establishes contact with the closest authorized RSA provider in accordance with the user location in real time.

Q3. Is AutoAssist.AI able to process insurance claims?

Yes, it takes users through the entire process of submitting claims, uploading documents and offers tracking of claims to resolution in real-time.

Q4. Is AutoAssist.AI a mobile app product?

No. It’s available through mobile apps, web sites, and WhatsApp so that it will be as convenient as possible.

Q5 What is the difference between a normal chatbot and AutoAssist.AI?

AutoAssist.AI is intelligent, industry-specific and integrated with RSA networks and insurance systems to generate actual results, not just generic responses.

Email Us: [email protected]

Visit: https://www.tecosys.in/